The coronavirus pandemic has caused some delays and challenges when it comes to valuers and surveyors safely visiting properties to provide valuations. In many cases, these valuations can be automated, but there will still often be times when the property valuer will need to visit the property in person.

Homebuyers also have the option to arrange more detailed property surveys, such as a Homebuyer’s Report, or a full structural survey. These can provide greater protection for the buyer as they provide more detailed information about the property.

Covid-19 and lockdown measures meant that many valuations and surveys had to be put on hold temporarily. Lenders and their valuers are now working through the backlog but there have inevitably been delays.

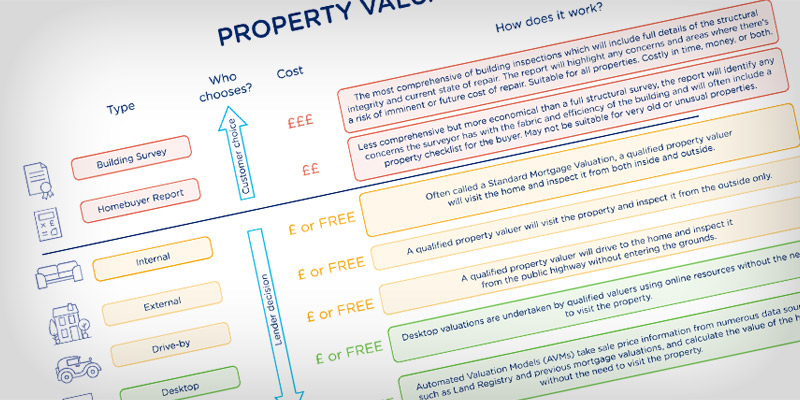

Our infographic helps to explain the different types of valuations and surveys and the impact of the pandemic on timescales.

Click the image below to view our infographic in full: