News & Insight

Our expert views and commentary on what’s happening in the world of mortgages and sometimes beyond, along with our regular summary of what the papers say.

Lisa Parker - 17/03/2023

One in four first time buyers now pay stamp duty

Lisa Parker - 19/07/2022

Adding partners or spouses onto an existing mortgage

Lisa Parker - 26/03/2021

Stamp duty holiday extension

Lisa Parker - 05/03/2021

What is stamp duty? A factsheet

Lisa Parker - 03/11/2020

Market update: More support for first time buyers

Lisa Parker - 23/07/2020

Scotland and Wales follow England and NI stamp duty holiday

David Hollingworth - 20/07/2020

Stamp Duty Boost for Homebuyers

David Hollingworth - 10/07/2020

Why now is a good time for first time buyers

Lisa Parker - 28/01/2020

What the papers said about interest rates and election pledges

Lisa Parker - 06/11/2019

Low mortgage rates provide Buy to Let boost

Lisa Parker - 28/10/2019

Buying for Uni

David Hollingworth - 03/09/2019

What First Time Buyers should know about saving for a deposit

Lisa Parker - 22/08/2019

Are you improving rather than moving?

Lisa Parker - 24/07/2019

Lenders cut mortgage rates for landlords

Lisa Parker - 23/07/2019

First-time buyers bypass flats

David Hollingworth - 05/07/2019

House of Lords calls for stamp duty review

David Hollingworth - 02/05/2019

Overseas buyers to pay higher stamp duty

David Hollingworth - 18/04/2019

New tax year changes for landlords

David Hollingworth - 12/03/2019

What did the Budget hold for the Housing Market?

Lisa Parker - 31/10/2018

What will the Budget mean for the property market?

David Hollingworth - 26/10/2018

What the papers said about older borrowers and stamp duty

Lisa Parker - 22/08/2018

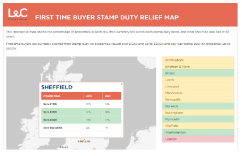

First-time buyers in the dark about stamp duty changes

David Hollingworth - 16/08/2018

What the papers say about First Time Buyer Stamp Duty Relief

David Hollingworth - 13/06/2018

4m homes could no longer qualify for stamp duty relief by 2028

David Hollingworth - 07/06/2018

What the papers said about first-time buyers

Lisa Parker - 02/05/2018

Stamp duty exemption benefits more than 16,000 so far

David Hollingworth - 18/01/2018

What are your 2018 mortgage resolutions?

David Hollingworth - 05/01/2018

First Time Buyer Stamp Duty Cut

Peter Gettins - 23/11/2017

What the Budget could mean for the property market

David Hollingworth - 21/11/2017

What the papers said about Autumn Budget predictions

Lisa Parker - 21/11/2017

What the papers said about home ownership and stamp duty

Lisa Parker - 15/08/2017

10 Point Checklist for First Time Buyers in 2014

Peter Gettins - 23/09/2014

There have been so many changes to the property market within the last few years, that for first time buyers coming into the market right now, it’s like a whirlwind. Knowing the right places to look; the appropriate checks to ensure you do; and the changes in mortgage rates and house prices; it’s almost like you need a degree to understand everything involved in the process of buying a house.So here’s a quick guide to the most important things yo...