News & Insight

Our expert views and commentary on what’s happening in the world of mortgages and sometimes beyond, along with our regular summary of what the papers say.

Lisa Parker - 16/04/2024

Could 99% mortgages be on the cards?

David Hollingworth - 15/02/2024

What are the pros and cons of buying a property jointly?

Lisa Parker - 13/02/2024

Property sellers offer biggest discounts since 2018

Lisa Parker - 01/12/2023

Half of homeowners had help buying their first home

Lisa Parker - 06/09/2023

First-time buyers failing to factor in all buying costs

Lisa Parker - 22/07/2023

Could a 100% mortgage be right for you?

Lisa Parker - 16/05/2023

Green mortgage options increase

Lisa Parker - 17/03/2023

Mortgage Guarantee Scheme extended for a year

Lisa Parker - 30/12/2022

Six mortgage and property resolutions for 2023

Lisa Parker - 29/12/2022

Race is on to beat Help to Buy October deadline

Lisa Parker - 19/10/2022

Bank of England to withdraw mortgage affordability rules

David Hollingworth - 21/07/2022

SVR Watch June 22

Lisa Parker - 19/07/2022

One in four first time buyers now pay stamp duty

Lisa Parker - 19/07/2022

Nine mortgage myths busted

Lisa Parker - 29/06/2022

Help to Buy scheme to close to new applicants in October

Lisa Parker - 27/06/2022

Mortgage guarantee scheme helps thousands to buy homes

Lisa Parker - 31/05/2022

Owning a home costs nearly £1,400 less a year than renting

Lisa Parker - 11/04/2022

SVR Watch February 2022

Lisa Parker - 16/03/2022

Bank of England raises interest rates

Lisa Parker - 16/12/2021

Home mover numbers reach record high

David Hollingworth - 30/11/2021

Lockdown savings boost first time buyer budgets

David Hollingworth - 02/08/2021

Mortgage rates fall to historic lows

Lisa Parker - 23/06/2021

Home movers overtake first time buyers

David Hollingworth - 18/06/2021

Government begins roll out of First Homes scheme

Lisa Parker - 04/06/2021

Rise in new homes receiving top energy efficiency grades

Lisa Parker - 11/05/2021

Nationwide gives first time buyers a borrowing boost

David Hollingworth - 07/05/2021

Help for homebuyers with small deposits

Lisa Parker - 05/03/2021

Stamp duty holiday extension

Lisa Parker - 05/03/2021

Your seven-step moving home checklist

Lisa Parker - 23/02/2021

New Help to Buy scheme for 2021-2023

Lisa Parker - 16/12/2020

Market update November 2020

Lisa Parker - 27/11/2020

Property activity continues to rise in October

David Hollingworth - 19/11/2020

What is stamp duty? A factsheet

Lisa Parker - 03/11/2020

What new COVID restrictions mean for your property purchase or remortgage

Lisa Parker - 28/10/2020

Keyworkers offered access to lower mortgage rates

David Hollingworth - 21/10/2020

Fixed mortgage rates start to rise

Lisa Parker - 19/08/2020

Government confirms Help to Buy deadline extension

Lisa Parker - 12/08/2020

Government reveals affordable housing plans

David Hollingworth - 10/08/2020

Base rate held at 0.1% in August

David Hollingworth - 07/08/2020

House prices rebound in July helped by Stamp Duty holiday

David Hollingworth - 06/08/2020

Shake-up of leasehold system proposed

Lisa Parker - 04/08/2020

Market update: More support for first time buyers

Lisa Parker - 23/07/2020

Scotland and Wales follow England and NI stamp duty holiday

David Hollingworth - 20/07/2020

Stamp Duty Boost for Homebuyers

David Hollingworth - 10/07/2020

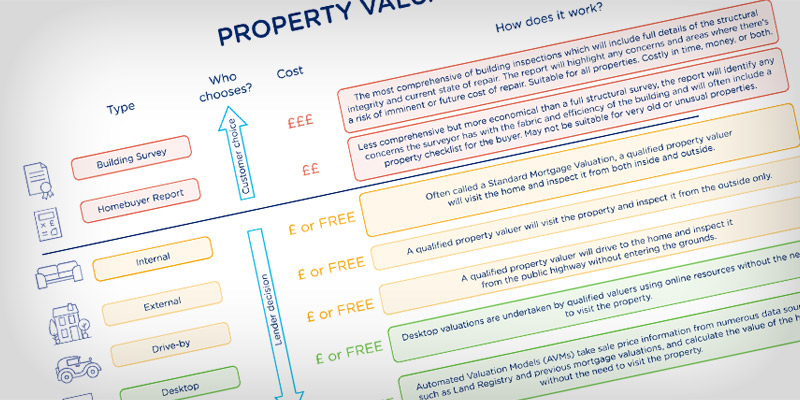

Your Guide to Property Valuations and Surveys

David Hollingworth - 02/07/2020

Nationwide joins lenders in lowering loan-to-value ceilings

Lisa Parker - 29/06/2020

Market update: Lenders working through lockdown backlog

David Hollingworth - 17/06/2020

Mortgage market update - Lenders re-introduce deals

David Hollingworth - 27/05/2020

Property market re-opens for business

Lisa Parker - 26/05/2020

Mortgage market update - What happens next?

Lisa Parker - 14/05/2020

Lenders revise affordability criteria for those affected by Covid-19

David Hollingworth - 06/05/2020

Coronavirus: what it means for your mortgage

Lisa Parker - 06/04/2020

SVR Watch - March 2020

Peter Gettins - 31/03/2020

Home-movers advised to delay plans

David Hollingworth - 30/03/2020

Base rate cut to record low

David Hollingworth - 24/03/2020

Budget 2020: How it affects the property market

David Hollingworth - 16/03/2020

Interest rates cut back to lowest level in history

Lisa Parker - 13/03/2020

Housing market update

David Hollingworth - 09/03/2020

Overpaying your mortgage

Lisa Parker - 28/02/2020

What the papers said about split mortgages and older borrowers

Lisa Parker - 25/02/2020

Mortgages for working parents: What you need to know

David Hollingworth - 13/02/2020

Government announces new build discounts for first time buyers

David Hollingworth - 10/02/2020

Should you say ‘I do’ to a joint mortgage?

Lisa Parker - 07/02/2020

With Valentine’s Day around the corner you might be starting to feel a bit romantic. Perhaps you’re thinking about moving in with your partner, or even popping the question? There’s a practical consideration you’ll want to think about before you make the big commitment of living together: How will the mortgage work?...

Gulf between cheapest and most expensive properties revealed

David Hollingworth - 04/02/2020

More mortgage options for buyers with small deposits

David Hollingworth - 28/01/2020

Why now is a good time for first time buyers

Lisa Parker - 28/01/2020

Property market predictions – what’s on the cards for 2020?

David Hollingworth - 24/01/2020

January the best month for a quick property sale

Lisa Parker - 17/01/2020

What are YOUR 2020 mortgage resolutions?

David Hollingworth - 13/01/2020

What the papers said about house prices and small deposits

Lisa Parker - 13/01/2020

2019 Mortgage market review of the year

David Hollingworth - 07/01/2020

New year, new financial you?

Lisa Parker - 03/01/2020

Scottish first time buyers given leg up onto property ladder

Lisa Parker - 03/01/2020

Positive September for first time buyers and remortgages

Lisa Parker - 26/11/2019

What the papers said about interest rates and election pledges

Lisa Parker - 06/11/2019

Shared ownership boost for lower earners

David Hollingworth - 28/10/2019

Is your self-employed paperwork up to date?

David Hollingworth - 15/10/2019

Top first-time buyer misconceptions revealed

Lisa Parker - 25/09/2019

Low deposit mortgages at highest level for 11 years

David Hollingworth - 24/09/2019

‘Affordable hotspots’ for first-time buyers revealed

David Hollingworth - 16/09/2019

More help for lower earners wanting to get on the property ladder

Lisa Parker - 04/09/2019

What First Time Buyers should know about saving for a deposit

Lisa Parker - 22/08/2019

Older homeowners stay put for nearly two decades

Lisa Parker - 22/08/2019

Uncertainty causes mortgage market slowdown

Lisa Parker - 21/08/2019

Number of Help to Buy loans up by 9%

Lisa Parker - 16/08/2019

Are you improving rather than moving?

Lisa Parker - 24/07/2019

Can you get a mortgage if you work for yourself?

Lisa Parker - 24/07/2019

Leaseholds axed for all new houses

David Hollingworth - 23/07/2019

Longer term mortgages on the rise

Lisa Parker - 15/07/2019

Government announces funding for green mortgages

Lisa Parker - 05/07/2019

First-time buyers bypass flats

David Hollingworth - 05/07/2019

IKEA to build low cost homes

Lisa Parker - 04/07/2019

Why you might be turned down for a mortgage (and what you can do about it)

Lisa Parker - 25/06/2019

New mortgages for public sector heroes

David Hollingworth - 21/06/2019

What the papers said about longer term deals and Help to Buy Isa’s

Lisa Parker - 05/06/2019

First-time buyers save more than £30,000 for deposit

David Hollingworth - 14/05/2019

First-time buyer numbers continue to rise

David Hollingworth - 13/05/2019

House of Lords calls for stamp duty review

David Hollingworth - 02/05/2019

What the papers said about 40-year terms and Buy-to-Let rates

Lisa Parker - 30/04/2019