News & Insight

Our expert views and commentary on what’s happening in the world of mortgages and sometimes beyond, along with our regular summary of what the papers say.

Bank of England holds base rate at 5.25%

How do cashback mortgages work?

Base rate held at 5.25% in February

What could the rise in inflation mean for your mortgage?

8 essential steps to take if you’re remortgaging or buying in 2024

Interest rates left unchanged for third consecutive month

Inflation drops sharply in October – what does it mean for you?

Interest rates held at 5.25%

Inflation sticks at 6.7%: what does it mean for you?

Self-employed mortgage applicants urged to prepare paperwork early

A year on from the mini-budget mortgage meltdown

Should I overpay on my mortgage?

More mortgage pain as base rate increases to 5.25%

Bigger than expected drop in inflation could be good news for mortgages

What should I do if my mortgage is maturing this year?

What the Mortgage Charter means for you

Mortgage market mayhem: what it means for you

Base rate increases for a record thirteenth consecutive time

Repossessions on the rise – what can borrowers do?

Should I leave my tracker mortgage?

Should you go for a short or long-term fixed rate mortgage?

Is now a good time to remortgage?

Interest rates jump to 15-year high

Green mortgage options increase

What should I do if my fixed rate is coming to an end?

Could you benefit from the mortgage price war?

Ways to make your property more energy efficient

Should I stick with my current lender or switch to a new lender?

Six mortgage and property resolutions for 2023

Should you go for a tracker or fixed rate mortgage?

SVR Watch November 2022

What the base rate increase means for you

Base rate rises to 3%

The Bank of England has raised the base rate by 0.75 percentage points to 3%, the biggest rate increase for 30 years. Some had expected rates to increase by a full percentage point, but action taken by the new Chancellor Jeremy Hunt to reverse tax cuts announced by his predecessor Kwasi Kwarteng may have helped to avert the need for such a substantial increase. Rates are rising to try to curb rampant inflation. The Consumer Prices Index measure of inflation rose by 10.1% in the year to Sep...

Interest rates jump to 2.25%

Borrowers urged to check if they can save by switching mortgage

Bank raises rates by biggest margin for almost 30 years.

Interest rates could top 2% in a year

Bank of England to withdraw mortgage affordability rules

SVR Watch June 22

Nine mortgage myths busted

Fifth consecutive rise for interest rates

Mortgage payments jump by £100 a month

Interest rates rise to 1%

How rising living costs could affect your mortgage

Bank of England raises interest rates to 0.75%

SVR Watch February 2022

How to get ahead of a base rate rise

Base rate jumps to 0.5%

Combat the cost of living squeeze by switching mortgage

Bank of England raises interest rates

Inflation soars to record high – is a rate rise on the horizon?

Bank of England keeps interest rates at 0.1%

L&C Mortgage Ratewatch

Base rate held at 0.1% despite soaring inflation

Rates held at 0.1% despite soaring inflation

Mortgage rates fall to historic lows

Borrowers urged to explore remortgage options

Adding partners or spouses onto an existing mortgage

Unanimous vote to hold base rate at 0.1%

Base rate held but negative rates possible

Further support for mortgage customers

What new COVID restrictions mean for your property purchase or remortgage

Mortgage payment holidays could be extended

Fixed mortgage rates start to rise

Base rate held at 0.1% in August

Improving rather than moving? Make the most of low mortgage rates

Shake-up of leasehold system proposed

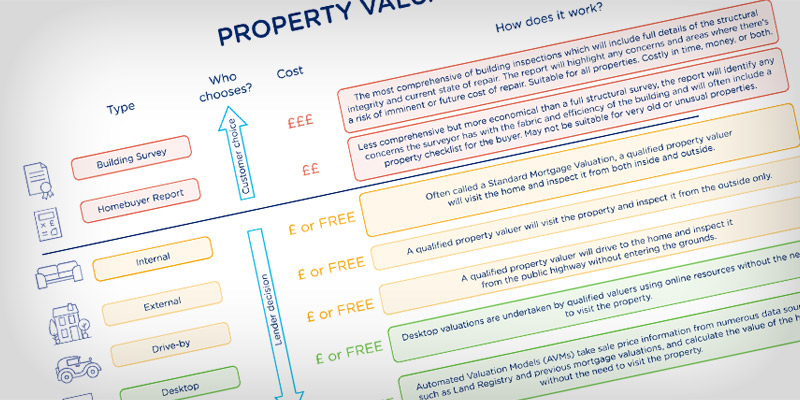

Your Guide to Property Valuations and Surveys

Barclays launches 10-year fixed rate mortgage below 2%

Nationwide joins lenders in lowering loan-to-value ceilings

Base rate held at 0.1% in June

Market update: Lenders working through lockdown backlog

Mortgage rates continue to fall

Mortgage payment holiday scheme extended

What would negative interest rates mean for your mortgage?

Mortgage market update - Lenders re-introduce deals

7 myths about switching your mortgage

Mortgage market update - What happens next?

Base rate held at 0.1%

Lenders revise affordability criteria for those affected by Covid-19

Mortgage market starts moving again

One in seven takes mortgage payment holiday

One in nine takes mortgage payment holiday

Should I switch to a new mortgage deal with my existing lender?

Credit scores protected during mortgage payment holidays

Coronavirus: what it means for your mortgage

SVR Watch - March 2020

Base rate cut to record low

Help With Mortgage Costs

Nationwide to offer interest-only mortgages

Budget 2020: How it affects the property market

Interest rates cut back to lowest level in history

Overpaying your mortgage

What the papers said about split mortgages and older borrowers

Mortgages for working parents: What you need to know

Should you say ‘I do’ to a joint mortgage?

With Valentine’s Day around the corner you might be starting to feel a bit romantic. Perhaps you’re thinking about moving in with your partner, or even popping the question? There’s a practical consideration you’ll want to think about before you make the big commitment of living together: How will the mortgage work?...